The post of Superintendent of Excise is a Group B position under the Excise Department of Assam. The officer is responsible for administrative activities and enforcing laws related to the production, distribution, and sale of alcohol and narcotics and revenue regulations. He/She has to ensure that excise duties are properly collected as well as crack down on the illegal liquor trade. In this article, we will discuss the entire recruitment process of how to become a superintendent of excise along with the job profile, salary details and the promotion

This post not only offers you a chance to be a key player in the state’s revenue generation but also empowers you to enforce laws that protect society from the harmful effects of illicit liquor and narcotics.

Role and Responsibilities

Candidates taking the Assam Public Service Commission’s (APSC) Combined Competitive Examination (CCE) find the position of Superintendent of Excise to be an appealing career choice because it combines administrative responsibility, field enforcement, and revenue regulation.

The officer oversees all excise operations in a particular district or zone.

Key Responsibilities of the Superintendent of Excise, Assam

| Function | Description |

| 1. Licensing & Regulation | Issues and regulates licenses for liquor vendors, distilleries, bottling units, and bonded warehouses to ensure legal compliance. |

| 2. Revenue Collection | Monitors the collection of excise duties from all licensed vendors and manufacturers, contributing significantly to the state’s revenue. |

| 3. Enforcement Drives | Conducts regular raids and enforcement operations to crack down on illegal liquor trade, bootlegging, and smuggling activities. |

| 4. Legal Action | Seizes illicit liquor and initiates legal proceedings against offenders under the Assam Excise Act and related laws. |

| 5. Law & Order Coordination | Works in close coordination with police authorities and district magistrates to maintain law and order in excise-related incidents. |

| 6. Public Awareness | Undertakes campaigns to educate the public on the health and social consequences of alcohol consumption and promote community involvement in curbing illicit trade. |

Eligibility Criteria

If you are exploring how to become a Superintendent of Excise in Assam, you must appear for the APSC Combined Competitive Examination (CCE) and secure a rank high enough to be selected for this post

| Criteria | Details |

| Educational Qualification | Bachelor’s degree in any discipline from a recognized university |

| Age Limit (As per APSC CCE 2025) | Minimum: 21 yearsMaximum: 38 years (General Category) |

| Age Relaxation | SC/ST(P)/ST(H): 5 yearsOBC/MOBC: 3 yearsPwD: 10 years |

| Nationality | Must be an Indian citizen |

| Domicile Preference | Preference to permanent residents of Assam |

Selection Process

On your wondering of how to become a Superintendent of Excise, you have to undergo a three-tier selection process of APSC CCE.

- Preliminary Examination

- Main Examination

- Interview Examination

Stage 1: Preliminary Examination

The Preliminary Examination of the Assam Public Service Commission (APSC) is the first stage of the APSC Combined Competitive Examination (CCE). It consists of two papers, each worth 200 marks and lasting two hours. The exam format is multiple-choice questions (MCQ), with General Studies Paper I focused on general knowledge and General Studies Paper II dedicated to the Aptitude Test. The total score for the two-hour test is 400 marks. General Studies Paper I contains 100 questions, while the CSAT paper includes 80 questions.

Although the results of this qualifying exam will not contribute to the final merit list, candidates must pass it to be eligible for the Mains Examination.

Stage 2: Mains Examination

The APSC Main Examination is conducted in a descriptive format. It consists of six papers, each worth 250 marks. You will have 3 hours to complete each paper, with a total of 1500 marks for the mains. Once you qualify for the main exams, you will be called for the examination.

| Paper | Subject | Syllabus Highlights |

| Paper 1 | Essay | Writing essays on multiple topics — social, economic, political, cultural, environmental, and contemporary national/international issues |

| Paper 2 | General Studies I | Indian History, Indian National Movement, Indian Culture, Indian Society, and Indian & World Geography |

| Paper 3 | General Studies II | Indian Constitution, Polity, Governance, Public Policy, Social Justice, Rights Issues, International Relations |

| Paper 4 | General Studies III | Economic Development, Agriculture, Environment & Ecology, Science & Technology, Disaster Management |

| Paper 5 | General Studies IV (Ethics) | Ethics, Integrity, Attitude, Emotional Intelligence, Moral Thinkers, and Case Studies in public administration |

| Paper 6 | Assam Specific Paper | Assam’s History, Culture, Society, Geography, Polity, Economy, and Contemporary Issues |

Stage 3: Interview (Personality Test)

- Total marks: 180

- The viva voce evaluates your personality, general awareness, and understanding of public administration.

Total Marks

- Written Examination (6 Papers): 1500 marks

- Interview/Personality Test: 180 marks

- Grand Total: 1680 marks

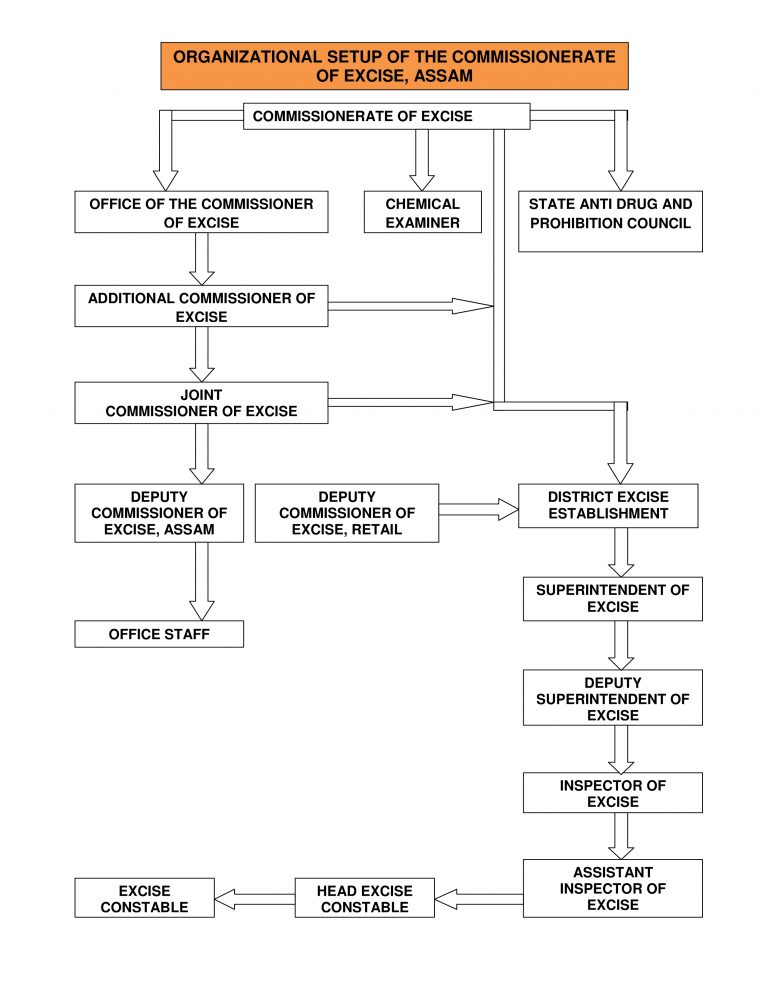

Organizational Setup of the Commissionerate of Excise, Assam

The Commissionerate of Excise, Assam, operates under the administrative control of the state government’s Department of Excise. The state excise department’s ranks are structured with a hierarchical setup: the Commissioner of Excise, who is the chief controlling authority responsible for the overall administration, regulation, and enforcement of excise laws in the state. He is assisted by the commissioner are additional commissioners, deputy commissioners, superintendents, inspectors, and other subordinate staff who are stationed across various districts and excise ranges.

Assuring compliance with the Assam Excise Act and Rules, the department’s main responsibility is to regulate the production, ownership, transportation, sale, and consumption of alcohol and other intoxicants. By levying and collecting excise taxes, it also contributes significantly to the state’s revenue generation.

Top-Level Authority

- Commissionerate of Excise

Directly Under the Commissionerate

- Office of the Commissioner of Excise

- Chemical Examiner

- State Anti-Drug and Prohibition Council

Hierarchical Structure (Administrative)

- Office of the Commissioner of Excise

- Additional Commissioner of Excise

- Joint Commissioner of Excise

- Deputy Commissioner of Excise, Assam

- Office Staff

- Deputy Commissioner of Excise, Retail

- Coordinates with the District Excise Establishment

- Coordinates with the District Excise Establishment

- Deputy Commissioner of Excise, Assam

- Joint Commissioner of Excise

- Additional Commissioner of Excise

- District Excise Establishment

- Superintendent of Excise

- Deputy Superintendent of Excise

- Inspector of Excise

- Assistant Inspector of Excise

- Head Excise Constable

- Excise Constable

- Excise Constable

- Head Excise Constable

- Assistant Inspector of Excise

- Inspector of Excise

- Deputy Superintendent of Excise

- Superintendent of Excise

Career Growth and Promotion of the Superintendent of Excise in Assam

The Assam Excise Superintendent post opens the door to a long and prestigious career in public service. Promotions and career growth are based on a combination of seniority, performance, and vacancies. To become a Superintendent of Excise, you must typically enter the service through the Assam Public Service Commission (APSC) examination or be promoted from lower ranks within the Excise Department, such as Inspector of Excise.

Promotion Timeline and Hierarchy:

| Service Duration | Post Designation |

| Entry-Level | Superintendent of Excise |

| After 6-8 Years | Joint Commissioner (Excise) |

| After 10-15 Years | Deputy Commissioner (Excise) |

| After 20+ Years | Additional Commissioner or Commissioner |

Another key point for promotion is performance reviews, administrative leadership, and clean service records often accelerate promotions. Officers may also be transferred to other departments such as District Administration, Revenue, or Municipal Affairs at similar pay levels.

Deputation to Central Services

For deputation to Central Government departments, senior Excise officers from the Assam Civil Services, including those who started out as Superintendents of Excise, may be given consideration. The Department of Personnel and Training’s (DoPT) standard operating procedures facilitate this, and they are founded on :

Eligibility for Central Deputation:

- Minimum 9 – 10 years of state service

- Recommendation by the state government

- Vigilance clearance and annual performance appraisals

- Availability of posts in ministries such as

- Ministry of Finance

- Central Board of Indirect Taxes and Customs (CBIC)

- Narcotics Control Bureau

- Department of Revenue

An officer on central deputation may work for the Ministry of Finance, the Central Board of Indirect Taxes and Customs (CBIC), or even specialized enforcement units dealing with taxes or drugs. An officer’s experience, network, and career prospects can all be greatly improved by such central postings, which also frequently result in an expedited promotion back into the state cadre.

Salary of Superintendent of Excise

One of the major attractions of this post is the lucrative salary package, along with other government perks and allowances.

| Component | Amount (in ₹) |

| Basic Pay | ₹30,000–₹110,000 |

| Grade Pay | ₹12,700 |

| Dearness Allowance (DA) | As per applicable government rates |

| House Rent Allowance (HRA) | 8%–16% of basic pay (depending on posting) |

| Travel Allowance (TA) | As applicable |

| Other Allowances | Uniform allowance, special duty allowance etc. |

Excise Department – IAS Cadre Pay Structure

| Designation | Pay Band | Grade Pay |

| Additional Commissioner of Excise | PB-4 ₹12,000–40,000 | ₹7,400 |

| Joint Commissioner of Excise | PB-4 ₹12,000–40,000 | ₹6,400 |

| Deputy Commissioner of Excise | PB-4 ₹12,000–40,000 | ₹6,300 |

| Chemical Examiner of Excise | PB-4 ₹12,000–40,000 | ₹6,300 |

| Deputy Chemical Examiner of Excise | PB-4 ₹12,000–40,000 | ₹5,900 |

| Assistant Analyst | PB-4 ₹12,000–40,000 | ₹5,400 |

| Superintendent of Excise | PB-4 ₹12,000–40,000 | ₹5,400 |

| Deputy Superintendent of Excise | PB-3 ₹8,000–35,000 | ₹4,600 |

| Inspector of Excise | PB-3 ₹8,000–35,000 | ₹4,300 |

| Assistant Inspector of Excise | PB-2 ₹5,200–20,200 | ₹2,400 |

| Excise Head Constable | PB-2 ₹5,200–20,200 | ₹2,200 |

| Excise Constable | PB-2 ₹5,200–20,200 | ₹2,000 |

Excise Department – ACS Cadre Pay Structure

| Designation | Pay Band | Grade Pay |

| Additional Commissioner of Excise | PB-4 ₹30,000–110,000 | ₹16,900 |

| Joint Commissioner of Excise | PB-4 ₹30,000–110,000 | ₹15,100 |

| Deputy Commissioner of Excise | PB-4 ₹30,000–110,000 | ₹14,500 |

| Chemical Examiner of Excise | PB-4 ₹30,000–110,000 | ₹14,500 |

| Deputy Chemical Examiner of Excise | PB-4 ₹30,000–110,000 | ₹13,300 |

| Assistant Analyst | PB-4 ₹30,000–110,000 | ₹12,700 |

| Superintendent of Excise | PB-4 ₹30,000–110,000 | ₹12,700 |

| Deputy Superintendent of Excise | PB-3 ₹22,000–87,000 | ₹10,300 |

| Inspector of Excise | PB-3 ₹22,000–87,000 | ₹9,100 |

| Assistant Inspector of Excise | PB-2 ₹14,000–49,000 | ₹6,200 |

| Excise Head Constable | PB-2 ₹14,000–49,000 | ₹5,600 |

| Excise Constable | PB-2 ₹14,000–49,000 | ₹5,000 |

Perks & Benefits of Superintendent of Excise

| Perk/Benefit | Details |

| 1. Government Accommodation or HRA | Allotted government quarters or House Rent Allowance (as per state rules). |

| 2. Official Vehicle (in some cases) | Some states may provide a vehicle, especially in field postings. |

| 3. Provident Fund & Pension | Eligible for GPF/NPS and pension under government schemes. |

| 4. Medical Benefits | Free or subsidized treatment in government hospitals or through CGHS/State Health Scheme. |

| 5. Leave Travel Concession (LTC) | Reimbursement for travel within India for self and family. |

| 6. Job Security & Social Prestige | Permanent government post with high social respect, especially in rural areas. |

| 7. Power to Enforce Law | Authorized to conduct inspections and raids and enforce excise laws. |

| 8. Disciplinary Authority | Can initiate action against violations of excise rules and oversee staff. |

Assam Excise Department Overview

The Assam Excise Department, the oldest revenue-generating department, operates under the Finance Department of the Government of Assam. It enforces the Assam Excise Act, 2000, regulates alcohol trade, and controls the manufacture, possession, sale, purchase, transport, and consumption of liquor and other intoxicants within the state.

Functions of the Department:

- Regulation of liquor production and sale

- Control of the manufacture and distribution of alcoholic beverages

- observing bottling facilities and distilleries

- Applying excise taxes

- Stopping illegal trade and bootlegging

- Revenue-generating via excise taxes

The Excise department plays an important role in the state’s economy and public health management.

Integration with Central Excise and GST

Coordination with central agencies is crucial even though the Assam Excise Department functions at the state level.

- Superintendent of Central Excise: A central government position overseeing excise duties on goods and services.

- Superintendent of GST and Central Excise: Post-GST implementation, this role covers responsibilities related to Goods and Services Tax and central excise duties.

- Deputy Superintendent of Excise: Assists in managing central excise operations and ensuring compliance with national tax laws.

These roles require close collaboration between state and central departments to ensure seamless and smooth tax administration.

Current Leadership: Excise Minister of Assam

Sri Parimal Suklabaidya is the Hon’ble Minister of Excise, Assam, as of 2025. He heads in directing policy choices, bolstering enforcement strategies, and enhancing excise administration’s transparency. Through modernization and more stringent regulations, the department has made great strides under his direction to reduce the illegal liquor trade and increase revenue collection.

How to Prepare for the APSC CCE

To be selected for the Excise Superintendent post, you need to secure a top rank in the APSC CCE. If you’re wondering how to become a Superintendent of Excise, your preparation must be focused, disciplined, and strategic to outperform the competition and achieve success.

Suggested Preparation Plan:

- Prelims:

- Read NCERTs thoroughly

- Refer to standard books for Polity (Laxmikanth), History (Spectrum), Economy (Ramesh Singh), etc.

- Practice MCQs and attempt mock tests.

- Religiously follow the current affair

- Mains:

- Write answers daily for essay and GS papers. Time-bound answer writing can keep you one step ahead in the competition.

- Keep notes on current affairs, especially Assam-related topics

- Interview:

- Improve communication and presentation skills

- Be updated on recent policies and excise-related issues

- Take mock interviews for feedback

Important Topics for Excise Superintendent Aspirants:

- Excise Laws and Policies in Assam

- Government regulations on liquor and narcotics

- Revenue collection systems

- Public health implications of alcohol consumption

- Smuggling and enforcement mechanisms

For candidates seeking an administrative position that blends fieldwork, governance, and enforcement, the position of Superintendent of Excise in Assam is perfect. It provides long-term career security and prestige with a competitive salary, quick promotions, and central deputation opportunities.

For those wondering how to become a Superintendent of Excise, you can land this esteemed position by thoroughly preparing for the APSC CCE.

Frequently Asked Questions

Is the Superintendent of Excise a gazetted post?

Yes, it is a Group B gazetted officer post under Assam Civil Services.

Can women apply for this post?

Yes. The post is open to all eligible candidates, including women. Female officers are regularly selected and posted in field roles.

Is there a physical test for this post?

No. The selection is purely based on written exams and interviews. However, basic physical and mental fitness is necessary.

Do I need to choose this post specifically during application?

No. You appear for the APSC CCE and select your service preference at a later stage based on your rank.

How to become a Superintendent of Excise in Assam?

You must appear for the Assam Public Service Commission Combined Competitive Examination (APSC CCE). The selection process includes a preliminary exam, Mains (descriptive), and an interview (personality test). Candidates securing top ranks can be selected for this post.

What is the salary of the Superintendent of Excise in Assam?

The pay band is ₹30,000–₹110,000 with a grade pay of ₹12,700. Additional allowances include HRA (8%–16%), DA (as applicable), TA, and other perks such as accommodation and medical benefits.

Can Superintendents of Excise be deputed to central government posts?

Yes, eligible officers can be deputed to central departments like the Ministry of Finance, CBIC, or Narcotics Control Bureau after 9–10 years of service, subject to recommendation and performance.

Who is the current Excise Minister of Assam?

As of 2025, Sri Parimal Suklabaidya is the Hon’ble Minister of Excise, Assam.