The Assistant Treasury Officer (ATO) is a key entry-level position within the Assam Finance Service. It functions under the Junior Grade-II cadre. ATOs look into the district treasuries and sub-treasuries to ensure that government transactions are done on a timely basis and in an accountable manner. As part of Assam’s financial accountability system, the ATO plays an important role in implementing budgetary provisions and financial policies at the ground level. In this article, we will discuss everything related to the post of Assistant Treasury Officer (ATO), from eligibility, recruitment process, and salary, to career growth.

Position and Classification of Assistant Treasury Officer in Assam

| Parameter | Details |

| Cadre | Junior Grade-II |

| Department | Finance (Accounts & Treasuries), Government of Assam |

| Category | Group ‘B’ Gazetted Officer |

| Equivalent Designations | Assistant Accounts Officer (AAO)Treasury OfficerFinance & Accounts Officer |

Key Roles and Responsibilities of an ATO in Assam

Assistant Treasury Officers mainly look into the maintenance of financial discipline in the treasury system. Their main duties include checking bills, making sure spending follows the budget, verifying voucher entries, keeping track of cash flow, and preparing financial reports for the Finance Department. They help prevent the misuse of public money and also guide and supervise the junior staff working in treasury offices.

| Functional Area | Key Duties |

| Treasury Management | Oversee the disbursement of government payments and ensure adherence to rules |

| Bill Verification | Scrutinize and pass salary, pension, and contractor bills |

| Fund Accounting | Maintain accurate accounting of receipts and payments |

| Audit Assistance | Coordinate audit processes and ensure rectification of audit objections |

| Financial Compliance | Ensure compliance with Assam Financial Rules, Treasury Rules, and SOs |

| Reporting & Reconciliation | Prepare treasury accounts and reconcile with bank and departmental records |

| Advisory Role | Advise departments on financial procedures and fund utilization |

Eligibility Criteria to become an ATO in Assam

1. Educational Qualification

| Category | Qualification Requirement |

| General | Bachelor’s Degree with 55% aggregate – For B.Com: 55% in Honours – For BA/B.Sc (Maths/Stats): 55% in aggregate or Honours |

| SC/ST/OBC/MOBC | Minimum 50% marks in a Bachelor’s Degree |

| Departmental Candidates | Minimum 50% marks in a Bachelor’s Degree |

2. Computer Proficiency

- Minimum 3-month diploma in Computer Applications is mandatory.

3. Age Limit (as of 01/01/2025)

| Category | Minimum Age | Maximum Age | Relaxation |

| General | 21 years | 38 years | |

| OBC/MOBC | 21 years | 41 years | 3 years |

| SC/ST | 21 years | 43 years | 5 years |

| PwBD | 21 years | 48 years | 10 years |

4. Domicile Requirement

- Must be an Indian citizen and a permanent resident of Assam.

- Proof: PRC for educational purposes or Employment Exchange Registration Certificate.

How to become an ATO in Assam

The post of Assistant Treasury Officer (ATO) is filled according to the Assam Finance Service Rules, 2019. These rules set the legal and administrative guidelines for hiring and service conditions. You can be an ATO in two ways — either through direct recruitment by the Assam Public Service Commission (APSC) or by promoting employees from lower finance service posts like Sub-Accountants and clerical staff. For direct recruitment, candidates must clear a competitive exam, followed by an interview and document verification.

1. Through APSC (Direct Recruitment – 50%)

Candidates must appear for the Assam Finance Service (Junior Grade-II) Competitive Examination conducted by the Assam Public Service Commission (APSC). The process includes:

| Stage | Details |

| Written Exam | Conducted by APSC. Subjects include General English, General Knowledge, Financial Rules & Accounts, Mathematics, and Viva Voce. |

| Merit List | Candidates are selected based on aggregate performance. |

| Training | Selected candidates undergo 6-month training + 3-month attachment |

| Bond | Must sign a bond to serve a minimum of 5 years after training. |

2. Through Departmental Promotion (50%)

Those already in service can get promoted in related state services such as :

- Assam Accounts Service

- District Treasury Service

- Local Fund Audit Service

Candidates must qualify through a Departmental (Promotion) Examination conducted by APSC. They must:

- Be a graduate

- Have at least 5 years of continuous service

- Be below 50 years of age

Salary Structure (as per 7th Pay Commission) of ATO

| Component | Approx. Amount |

| Basic Pay (Level 10) | ₹56,100–1,32,000/month |

| Dearness Allowance | DA% updated periodically |

| House Rent Allowance | Based on city classification |

| Travel Allowance | Per state rules for official duties |

| Special Duty Allowance (SDA) | 12.5% of basic pay (Assam posting) |

| Concurrent Charge Allowance | Up to 10%, if applicable |

Allowances & Perks

- Dearness Allowance (DA) – Based on state government notifications (Nov 2024), DA is regularly revised, e.g., an installment in December 2023

- House Rent Allowance (HRA) – Standard for government employees, varies by city classification (A/B/C).

- Travel Allowance (TA) – Entitlement for official duties/travel.

- Special Duty Allowance (SDA) – In NE states (including Assam), non‑All‑India Service officers get 12.5% of their basic pay when posted within the region

- Concurrent Charge Allowance – Up to 10% of the minimum pay scale when holding additional posts

Additional allowances may include medical, leave travel concession (LTC), and overtime pay as per state norms.

Career Ladder & Cadre Structure in Assam Finance Department

- Initial Entry

After training and attachment (6 months), you join Grade II, Class II—as a Treasury Officer (Level 10 pay scale). Promotions follow two streams: promotional & direct recruitment (50:50 quota) - Promotion Eligibility

- Eligibility: Typically requires 4 years of service in the current Grade/Class

- For some feeder posts like Accounts Officer, Audit Officer, or Senior Accounts Assistant, a minimum of 5 years of service is required to be eligible for promotion to Assistant Treasury Officer. In addition, the candidate must be a graduate and below 50 years of age.

- Assessment Methods

- Direct Committee selection based on merit & seniority (up to 4× the vacancies)

- Departmental (Promotion) Examinations, offering another path to move up

Typical Posts & Timelines

The Assam Finance Service (akin to PFAS in Uttar Pradesh) follows a structured progression

| Post | Role Description | Pay Level | Timeframe / Career Stage |

| Treasury Officer (Grade II) | Entry-level post | Level 10 | Starting position |

| Senior Treasury Officer (STO) /Finance & Accounts Officer | Supervisory treasury roles | Level 11 | Within ~8 years |

| Chief Treasury Officer (CTO) | Heads district/divisional treasury | Level 12 | Mid-career |

| Joint Director / Addl. Director (Treasury & Pensions) | Policy-level roles or Secretariat posting | Level 12–13 | After divisional posting |

| Additional Commissioner (Finance) | Under the Board of Revenue, the regional finance head | Level 13 | Senior-level |

| Secretariat Positions (e.g., Special Secretary) | High-level administrative policy roles in the Finance Secretariat | Levels 13A–14 | Senior-most level |

Promotion Process Overview

The ATO post provides a solid foundation for a career in public financial management. Based on the service and performance, an ATO can be promoted to higher posts such as Treasury Officer, Senior Financial Advisor, or Deputy Director of Accounts and Treasuries. The role not only offers job stability and prestige but also gives opportunities to contribute significantly to policy implementation and fiscal planning in Assam

| Stage | Process | Typical Years of Service |

| Initial | Direct recruitment or promotion entry | Entry level |

| First promotion | Departmental Exam / Committee Selection | After 4–5 years |

| Mid-career | Appointment to STO / CTO | ~8–15 years |

| Senior-level | Joint Director / Commissioner roles | 15+ years |

| Head-level | Secretariat positions (Addl. Sec., Spl. Sec.) | 20+ years |

- Departmental Exams: Held periodically by APSC for promotion to the next Grade.

- Committee Review: A chief-secretary-headed committee (including the Finance Secretary) reviews the overall performance for promotion as well as for suspension.

- Attachment & Training: Officers who get promoted go through a 3-month attachment period. During this period, they get training for their new role.

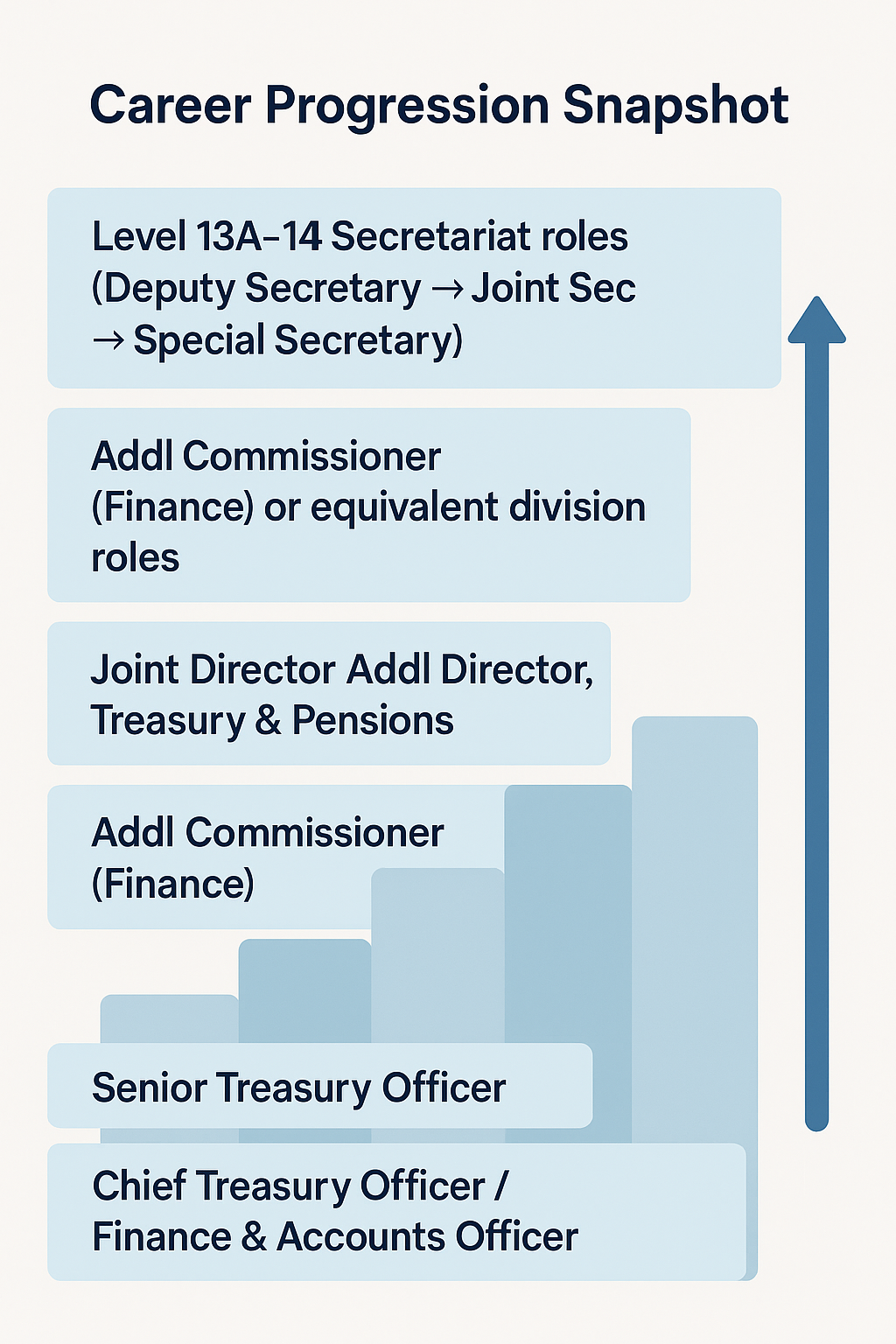

Career Progression Snapshot

- Treasury Officer (Grade II)

- Senior Treasury Officer / Finance & Accounts Officer

- Chief Treasury Officer

- Joint Director / Addl Director, Treasury & Pensions

- Addl Commissioner (Finance) or equivalent divisional roles

- Level 13A–14 Secretariat roles (Deputy Secretary → Joint Sec → Special Secretary)

Conclusion

In conclusion, the Assistant Treasury Officer plays a key role in managing the flow of government money in and out. This helps ensure transparency and financial discipline. Their role is vital during budget work, audits, and checking financial records. It is a stable, respectful, and challenging job for young graduates. With opportunities for training, promotion, and career growth, it is one of the most desirable jobs in the state government.

Frequently Asked Questions

1. What is the role of an Assistant Treasury Officer (ATO)?

The ATO oversees district and sub-treasuries, ensuring timely and lawful government transactions. They implement financial rules, check bills, maintain accounts, and assist with audits, thereby upholding financial discipline.

2. What are the eligibility criteria to become an ATO?

A Bachelor’s degree with at least 55% marks is required (50% for reserved categories). A 3-month computer diploma and permanent residency in Assam are also mandatory. The age limit is 21–38 years (relaxable by category).

3. How can one become an ATO in Assam?

There are two routes:

- Direct recruitment via APSC exam, interview, and training.

- Departmental promotion for serving finance staff with 5+ years’ service and graduation.

4. What is the exam pattern for ATO recruitment?

The APSC conducts a written exam covering English, GK, Financial Rules & Accounts, Maths, followed by a viva voce. Selected candidates undergo a 6-month training and 3-month field attachment.

5. What is the salary structure of an ATO?

The basic pay is ₹56,100–1,32,000 (Level 10), plus DA, HRA, Travel Allowance, Special Duty Allowance (12.5%), and other state-prescribed perks.

6. What are the key responsibilities of an ATO?

ATOs verify salary and pension bills, manage treasury accounts, ensure fund utilization as per rules, prepare reports, and supervise treasury staff. They also help in financial audits and compliance.

7. Is there a bond after selection as an ATO?

Yes, selected ATOs through direct recruitment must sign a bond committing to serve at least 5 years after completing training.

8. What is the career path after becoming an ATO?

An ATO can be promoted to Senior Treasury Officer, Chief Treasury Officer, Joint/Additional Director, and eventually to Secretariat positions like Special Secretary based on performance and seniority.

9. What are the promotion criteria for ATOs?

Promotion typically requires 4–5 years of service, good performance, and passing departmental exams. Committee-based selection is also used for higher posts.

10. Why is the ATO post considered prestigious?

It offers a secure government job with steady promotions, crucial financial responsibilities, and the chance to contribute to Assam’s fiscal governance, making it a highly sought-after career.